This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Verify borrower documents for consumer loans in minutes with confidence

Automate the capture and review of documents with extreme precision, so you can confidently make accurate AI-driven consumer lending decisions

When you need to make a decision for consumer loans such as auto financing or student loans, Ocrolus expedites your approval process with reliable data. Get started today with a simple implementation that requires zero document automation training.

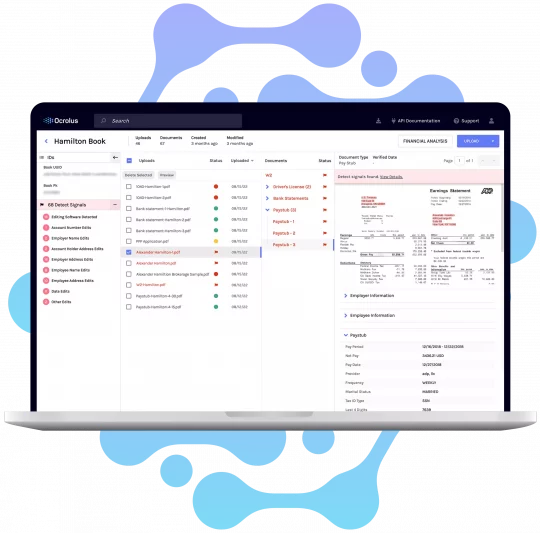

Machine-only products such as OCR software cannot deliver the level of accuracy and insights needed to accelerate better decision-making. Ocrolus’ intelligent consumer loan automation software powers your entire document workflow, from data extraction to fraud detection and cash flow analytics, so you can make faster and more accurate decisions. Enjoy easy-to-digest data, delivered with both tech-forward and traditional lenders in mind.

Effortlessly extract information from a full spectrum of personal loan documents to gain a holistic picture of borrower’s financial health with immediate ROI

Verify identity, employment, income, assets, address, and more for any traditional or non-traditional borrower

Authenticate critical information with speed and accuracy you can trust

Evaluate borrower creditworthiness with 100+ cash flow metrics, including income, expense, transactions, and trends

Minimize risk and make more informed decisions with data-driven insights

Quickly identify document tampering with clear context, intent, and advanced visualizations

Avoid losses incurred by funding fraudulent borrowers

Ready to go?

Connect with one of our consumer lending automation experts to see how you can accelerate decisions with trusted data.

Frequently Asked Questions

Consumer lending software may use advanced artificial intelligence and machine learning techniques to automate the capture, review, and verification of documents with extreme precision. This helps lenders to quickly and confidently make accurate consumer lending decisions.

Ocrolus’ intelligent consumer loan automation software powers your entire document workflow, from data extraction to fraud detection and cash flow analytics. To get a deep dive of our software, schedule your free demo: https://www.ocrolus.com/schedule-a-demo/.

The loan worklow is faster and more accurate with Ocrolus. We help to expedite your loan approval process with reliable data and improve your lending decisions.